Friday, September 28, 2007

The oath is precisely to protect and uphold the Constitution of the United States.

I took an oath many times, an oath of office as a Marine lieutenant, as an official in the Defense Department, as an official in the State Department as a Foreign Service officer. A number of times I took an oath of office which is the same oath office taken by every member of Congress and every official in the United States and every officer in the United States armed services.

And that oath is not to a Commander in Chief, which is not mentioned. It is not to a fuehrer. It is not even to superior officers. The oath is precisely to protect and uphold the Constitution of the United States.

Now that is an oath I violated every day for years in the Defense Department without realizing it when I kept my mouth shut when I knew the public was being lied into a war as they were lied into Iraq, as they are being lied into war in Iran.

--Daniel Ellsberg, the former Defense Department analyst who leaked the secret Pentagon Papers history of the Vietnam War, offered insights into the looming war with Iran and the loss of liberty in the United States at an American University symposium on Sept. 20.

[Consortiumnews.com]

...we could get back on track by merely living up to our oath of office.

--Ron Paul : When in the course of human events...

[You Tube]

(0) comments

Tuesday, September 25, 2007

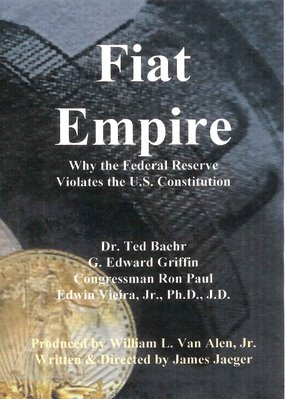

Ron Paul: Our Power, Our Responsibility

Paper Money and Tyranny

HON. RON PAUL OF TEXAS

IN THE HOUSE OF REPRESENTATIVES

September 5, 2003

All great republics throughout history cherished sound money. This meant that the monetary unit was a commodity of honest weight and purity. When money was sound, civilizations were found to be more prosperous and freedom thrived. The less free a society becomes, the greater the likelihood its money is being debased and the economic well-being of its citizens diminished.

Alan Greenspan, years before he became Federal Reserve Board Chairman in charge of flagrantly debasing the U.S. dollar, wrote about this connection between sound money, prosperity, and freedom. In his article “Gold and Economic Freedom” (The Objectivist, July 1966), Greenspan starts by saying: “An almost hysterical antagonism toward the gold standard is an issue that unites statists of all persuasions. They seem to sense…that gold and economic freedom are inseparable.” Further he states that: “Under the gold standard, a free banking system stands as the protector of an economy’s stability and balanced growth.”

Astoundingly, Mr. Greenspan’s analysis of the 1929 market crash, and how the Fed precipitated the crisis, directly parallels current conditions we are experiencing under his management of the Fed. Greenspan explains: “The excess credit which the Fed pumped into the economy spilled over into the stock market- triggering a fantastic speculative boom.” And, “…By 1929 the speculative imbalances had become overwhelming and unmanageable by the Fed.” Greenspan concluded his article by stating: “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.”

He explains that the “shabby secret” of the proponents of big government and paper money is that deficit spending is simply nothing more than a “scheme for the hidden confiscation of wealth.” Yet here we are today with a purely fiat monetary system, managed almost exclusively by Alan Greenspan, who once so correctly denounced the Fed’s role in the Depression while recognizing the need for sound money.

The Founders of this country, and a large majority of the American people up until the 1930s, disdained paper money, respected commodity money, and disapproved of a central bank’s monopoly control of money creation and interest rates. Ironically, it was the abuse of the gold standard, the Fed’s credit-creating habits of the 1920s, and its subsequent mischief in the 1930s, that not only gave us the Great Depression, but also prolonged it. Yet sound money was blamed for all the suffering. That’s why people hardly objected when Roosevelt and his statist friends confiscated gold and radically debased the currency, ushering in the age of worldwide fiat currencies with which the international economy struggles today.

If honest money and freedom are inseparable, as Mr. Greenspan argued, and paper money leads to tyranny, one must wonder why it’s so popular with economists, the business community, bankers, and our government officials. The simplest explanation is that it’s a human trait to always seek the comforts of wealth with the least amount of effort. This desire is quite positive when it inspires hard work and innovation in a capitalist society. Productivity is improved and the standard of living goes up for everyone. This process has permitted the poorest in today’s capitalist countries to enjoy luxuries never available to the royalty of old.

But this human trait of seeking wealth and comfort with the least amount of effort is often abused. It leads some to believe that by certain monetary manipulations, wealth can be made more available to everyone. Those who believe in fiat money often believe wealth can be increased without a commensurate amount of hard work and innovation. They also come to believe that savings and market control of interest rates are not only unnecessary, but actually hinder a productive growing economy.

Concern for liberty is replaced by the illusion that material benefits can be more easily obtained with fiat money than through hard work and ingenuity. The perceived benefits soon become of greater concern for society than the preservation of liberty. This does not mean proponents of fiat money embark on a crusade to promote tyranny, though that is what it leads to, but rather they hope they have found the philosopher’s stone and a modern alternative to the challenge of turning lead into gold.

Our Founders thoroughly understood this issue, and warned us against the temptation to seek wealth and fortune without the work and savings that real prosperity requires. James Madison warned of “The pestilent effects of paper money,” as the Founders had vivid memories of the destructiveness of the Continental dollar. George Mason of Virginia said that he had a “Mortal hatred to paper money.” Constitutional Convention delegate Oliver Ellsworth from Connecticut thought the convention “A favorable moment to shut and bar the door against paper money.”

This view of the evils of paper money was shared by almost all the delegates to the convention, and was the reason the Constitution limited congressional authority to deal with the issue and mandated that only gold and silver could be legal tender. Paper money was prohibited and no central bank was authorized. Over and above the economic reasons for honest money, however, Madison argued the moral case for such. Paper money, he explained, destroyed “The necessary confidence between man and man, on necessary confidence in public councils, on the industry and morals of people and on the character of republican government.”

The Founders were well aware of the biblical admonitions against dishonest weights and measures, debased silver, and watered-down wine. The issue of sound money throughout history has been as much a moral issue as an economic or political issue.

Even with this history and great concern expressed by the Founders, the barriers to paper money have been torn asunder. The Constitution has not been changed, but is no longer applied to the issue of money. It was once explained to me, during the debate over going to war in Iraq, that a declaration of war was not needed because to ask for such a declaration was “frivolous” and that the portion of the Constitution dealing with congressional war power was “anachronistic.” So too, it seems that the power over money given to Congress alone and limited to coinage and honest weights, is now also “anachronistic.”

If indeed our generation can make the case for paper money, issued by an unauthorized central bank, it behooves us to at least have enough respect for the Constitution to amend it in a proper fashion. Ignoring the Constitution in order to perform a pernicious act is detrimental in two ways. First, debasing the currency as a deliberate policy is economically destructive beyond measure. Second, doing it without consideration for the rule of law undermines the entire fabric of our Constitutional republic.

Though the need for sound money is currently not a pressing issue for Congress, it’s something that cannot be ignored because serious economic problems resulting from our paper money system are being forced upon us. As a matter of fact, we deal with the consequences on a daily basis, yet fail to see the connection between our economic problems and the mischief orchestrated by the Federal Reserve.

All the great religions teach honesty in money, and the economic shortcomings of paper money were well known when the Constitution was written, so we must try to understand why an entire generation of Americans have come to accept paper money without hesitation, without question. Most Americans are oblivious to the entire issue of the nature and importance of money. Many in authority, however, have either been misled by false notions or see that the power to create money is indeed a power they enjoy, as they promote their agenda of welfarism at home and empire abroad.

Money is a moral, economic, and political issue. Since the monetary unit measures every economic transaction, from wages to prices, taxes, and interest rates, it is vitally important that its value is honestly established in the marketplace without bankers, government, politicians, or the Federal Reserve manipulating its value to serve special interests.

Money As a Moral Issue

The moral issue regarding money should be the easiest to understand, but almost no one in Washington thinks of money in these terms. Although there is a growing and deserved distrust in government per se, trust in money and the Federal Reserve’s ability to manage it remains strong. No one would welcome a counterfeiter to town, yet this same authority is blindly given to our central bank without any serious oversight by the Congress.

When the government can replicate the monetary unit at will without regard to cost, whether it’s paper currency or a computer entry, it’s morally identical to the counterfeiter who illegally prints currency. Both ways, it’s fraud.

A fiat monetary system allows power and influence to fall into the hands of those who control the creation of new money, and to those who get to use the money or credit early in its circulation. The insidious and eventual cost falls on unidentified victims who are usually oblivious to the cause of their plight. This system of legalized plunder (though not constitutional) allows one group to benefit at the expense of another. An actual transfer of wealth goes from the poor and the middle class to those in privileged financial positions.

In many societies the middle class has actually been wiped out by monetary inflation, which always accompanies fiat money. The high cost of living and loss of jobs hits one segment of society, while in the early stages of inflation, the business class actually benefits from the easy credit. An astute stock investor or home builder can make millions in the boom phase of the business cycle, while the poor and those dependent on fixed incomes can’t keep up with the rising cost of living.

Fiat money is also immoral because it allows government to finance special interest legislation that otherwise would have to be paid for by direct taxation or by productive enterprise. This transfer of wealth occurs without directly taking the money out of someone’s pocket. Every dollar created dilutes the value of existing dollars in circulation. Those individuals who worked hard, paid their taxes, and saved some money for a rainy day are hit the hardest, with their dollars being depreciated in value while earning interest that is kept artificially low by the Federal Reserve easy-credit policy. The easy credit helps investors and consumers who have no qualms about going into debt and even declaring bankruptcy.

If one sees the welfare state and foreign militarism as improper and immoral, one understands how the license to print money permits these policies to go forward far more easily than if they had to be paid for immediately by direct taxation.

Printing money, which is literally inflation, is nothing more than a sinister and evil form of hidden taxation. It’s unfair and deceptive, and accordingly strongly opposed by the authors of the Constitution. That is why there is no authority for Congress, the Federal Reserve, or the executive branch to operate the current system of money we have today.

Money As a Political Issue

Although the money issue today is of little political interest to the parties and politicians, it should not be ignored. Policy makers must contend with the consequences of the business cycle, which result from the fiat monetary system under which we operate. They may not understand the connection now, but eventually they must.

In the past, money and gold have been dominant issues in several major political campaigns. We find that when the people have had a voice in the matter, they inevitably chose gold over paper. To the common man, it just makes sense. As a matter of fact, a large number of Americans, perhaps a majority, still believe our dollar is backed by huge hoards of gold in Fort Knox.

The monetary issue, along with the desire to have free trade among the states, prompted those at the Constitutional Convention to seek solutions to problems that plagued the post-revolutionary war economy. This post-war recession was greatly aggravated by the collapse of the unsound fiat Continental dollar. The people, through their representatives, spoke loudly and clearly for gold and silver over paper.

Andrew Jackson, a strong proponent of gold and opponent of central banking (the Second Bank of the United States,) was a hero to the working class and was twice elected president. This issue was fully debated in his presidential campaigns. The people voted for gold over paper.

In the 1870s, the people once again spoke out clearly against the greenback inflation of Lincoln. Notoriously, governments go to paper money while rejecting gold to promote unpopular and unaffordable wars. The return to gold in 1879 went smoothly and was welcomed by the people, putting behind them the disastrous Civil War inflationary period.

Grover Cleveland, elected twice to the presidency, was also a strong advocate of the gold standard.

Again, in the presidential race of 1896, William McKinley argued the case for gold. In spite of the great orations by William Jennings Bryant, who supported monetary inflation and made a mocking “Cross of Gold” speech, the people rallied behind McKinley’s bland but correct arguments for sound money.

The 20th Century was much less sympathetic to gold. Since 1913 central banking has been accepted in the United States without much debate, despite the many economic and political horrors caused or worsened by the Federal Reserve since its establishment. The ups and downs of the economy have all come as a consequence of Fed policies, from the Great Depression to the horrendous stagflation of the ‘70s, as well as the current ongoing economic crisis.

A central bank and fiat money enable government to maintain an easy war policy that under strict monetary rules would not be achievable. In other words, countries with sound monetary policies would rarely go to war because they could not afford to, especially if they were not attacked. The people could not be taxed enough to support wars without destroying the economy. But by printing money, the cost can be delayed and hidden, sometimes for years if not decades. To be truly opposed to preemptive and unnecessary wars one must advocate sound money to prevent the promoters of war from financing their imperialism.

Look at how the military budget is exploding, deficits are exploding, and tax revenues are going down. No problem; the Fed is there and will print whatever is needed to meet our military commitments, whether it’s wise to do so or not.

The money issue should indeed be a gigantic political issue. Fiat money hurts the economy, finances wars, and allows for excessive welfarism. When these connections are realized and understood, it will once again become a major political issue, since paper money never lasts. Ultimately politicians will not have a choice of whether to address or take a position on the money issue. The people and circumstances will demand it.

We do hear some talk about monetary policy and criticism directed toward the Federal Reserve, but it falls far short of what I’m talking about. Big-spending welfarists constantly complain about Fed policy, usually demanding lower interest rates even when rates are at historic lows. Big-government conservatives promoting grand worldwide military operations, while arguing that “deficits don’t matter” as long as marginal tax rates are lowered, also constantly criticize the Fed for high interest rates and lack of liquidity. Coming from both the left and the right, these demands would not occur if money could not be created out of thin air at will. Both sides are asking for the same thing from the Fed for different reasons. They want the printing presses to run faster and create more credit, so that the economy will be healed like magic- or so they believe.

This is not the kind of interest in the Fed that we need. I’m anticipating that we should and one day will be forced to deal with the definition of the dollar and what money should consist of. The current superficial discussion about money merely shows a desire to tinker with the current system in hopes of improving the deteriorating economy. There will be a point, though, when the tinkering will no longer be of any benefit and even the best advice will be of no value. We have just gone through two-and-a-half years of tinkering with 13 rate cuts, and recovery has not yet been achieved. It’s just possible that we’re much closer than anyone realizes to that day when it will become absolutely necessary to deal with the monetary issue- both philosophically and strategically- and forget about the band-aid approach to the current system.

Money as an Economic Issue

For a time, the economic consequences of paper money may seem benign and even helpful, but are always disruptive to economic growth and prosperity.

Economic planners of the Keynesian-socialist type have always relished control over money creation in their efforts to regulate and plan the economy. They have no qualms with using this power to pursue their egalitarian dreams of wealth redistribution. That force and fraud are used to make the economic system supposedly fairer is of little concern to them.

There are also many conservatives who do not endorse central economic planning as those on the left do, but nevertheless concede this authority to the Federal Reserve to manipulate the economy through monetary policy. Only a small group of constitutionalists, libertarians, and Austrian free-market economists reject the notion that central planning, through interest-rate and money-supply manipulation, is a productive endeavor.

Many sincere politicians, bureaucrats, and bankers endorse the current system, not out of malice or greed, but because it’s the only system they have know. The principles of sound money and free market banking are not taught in our universities. The overwhelming consensus in Washington, as well as around the world, is that commodity money without a central bank is no longer practical or necessary. Be assured, though, that certain individuals who greatly benefit from a paper money system know exactly why the restraints that a commodities standard would have are unacceptable.

Though the economic consequences of paper money in the early stage affect lower-income and middle-class citizens, history shows that when the destruction of monetary value becomes rampant, nearly everyone suffers and the economic and political structure becomes unstable. There’s good reason for all of us to be concerned about our monetary system and the future of the dollar.

Nations that live beyond their means must always pay for their extravagance. It’s easy to understand why future generations inherit a burden when the national debt piles up. This requires others to pay the interest and debts when they come due. The victims are never the recipients of the borrowed funds. But this is not exactly what happens when a country pays off its debt. The debt, in nominal terms, always goes up, and since it is still accepted by mainstream economists that just borrowing endlessly is not the road to permanent prosperity, real debt must be reduced. Depreciating the value of the dollar does that. If the dollar loses 10% of its value, the national debt of $6.5 trillion is reduced in real terms by $650 billion dollars. That’s a pretty neat trick and quite helpful- to the government.

That’s why the Fed screams about a coming deflation, so it can continue the devaluation of the dollar unabated. The politicians don’t mind, the bankers welcome the business activity, and the recipients of the funds passed out by Congress never complain. The greater the debt, the greater the need to inflate the currency, since debt cannot be the source of long-term wealth. Individuals and corporations who borrow too much eventually must cut back and pay off debt and start anew, but governments rarely do.

But where’s the hitch? This process, which seems to be a creative way of paying off debt, eventually undermines the capitalist structure of the economy, thus making it difficult to produce wealth, and that’s when the whole process comes to an end. This system causes many economic problems, but most of them stem from the Fed’s interference with the market rate of interest that it achieves through credit creation and printing money.

Nearly 100 years ago, Austrian economist Ludwig von Mises explained and predicted the failure of socialism. Without a pricing mechanism, the delicate balance between consumers and producers would be destroyed. Freely fluctuating prices provide vital information to the entrepreneur who is making key decisions on production. Without this information, major mistakes are made. A central planning bureaucrat cannot be a substitute for the law of supply and demand.

Though generally accepted by most modern economists and politicians, there is little hesitancy in accepting the omnipotent wisdom of the Federal Reserve to know the “price” of money- the interest rate- and its proper supply. For decades, and especially during the 1990s- when Chairman Greenspan was held in such high esteem, and no one dared question his judgment or the wisdom of the system- this process was allowed to run unimpeded by political or market restraints. Just as we must eventually pay for our perpetual deficits, continuous manipulation of interest and credit will also extract a payment.

Artificially low interest rates deceive investors into believing that rates are low because savings are high and represent funds not spent on consumption. When the Fed creates bank deposits out of thin air making loans available at below-market rates, mal-investment and overcapacity results, setting the stage for the next recession or depression. The easy credit policy is welcomed by many: stock-market investors, home builders, home buyers, congressional spendthrifts, bankers, and many other consumers who enjoy borrowing at low rates and not worrying about repayment. However, perpetual good times cannot come from a printing press or easy credit created by a Federal Reserve computer. The piper will demand payment, and the downturn in the business cycle will see to it. The downturn is locked into place by the artificial boom that everyone enjoys, despite the dreams that we have ushered in a “new economic era.” Let there be no doubt: the business cycle, the stagflation, the recessions, the depressions, and the inflations are not a result of capitalism and sound money, but rather are a direct result of paper money and a central bank that is incapable of managing it.

Our current monetary system makes it tempting for all parties, individuals, corporations, and government to go into debt. It encourages consumption over investment and production. Incentives to save are diminished by the Fed’s making new credit available to everyone and keeping interest rates on saving so low that few find it advisable to save for a rainy day. This is made worse by taxing interest earned on savings. It plays havoc with those who do save and want to live off their interest. The artificial rates may be 4, 5, or even 6% below the market rate, and the savers- many who are elderly and on fixed incomes- suffer unfairly at the hands of Alan Greenspan, who believes that resorting to money creation will solve our problems and give us perpetual prosperity.

Lowering interest rates at times, especially early in the stages of monetary debasement, will produce the desired effects and stimulate another boom-bust cycle. But eventually the distortions and imbalances between consumption and production, and the excessive debt, prevent the monetary stimulus from doing very much to boost the economy. Just look at what’s been happening in Japan for the last 12 years. When conditions get bad enough the only recourse will be to have major monetary reform to restore confidence in the system.

The two conditions that result from fiat money that are more likely to concern the people are inflation of prices and unemployment. Unfortunately, few realize these problems are directly related to our monetary system. Instead of demanding reforms, the chorus from both the right and left is for the Fed to do more of the same- only faster. If our problem stems from easy credit and interest-rate manipulation by the Fed, demanding more will not do much to help. Sadly, it will only make our problems worse.

Ironically, the more successful the money managers are at restoring growth or prolonging the boom with their monetary machinations, the greater are the distortions and imbalances in the economy. This means that when corrections are eventually forced upon us, they are much more painful and more people suffer with the correction lasting longer.

Today’s Conditions

Today’s economic conditions reflect a fiat monetary system held together by many tricks and luck over the past 30 years. The world has been awash in paper money since removal of the last vestige of the gold standard by Richard Nixon when he buried the Bretton Woods agreement- the gold exchange standard- on August 15, 1971. Since then we’ve been on a worldwide paper dollar standard. Quite possibly we are seeing the beginning of the end of that system. If so, tough times are ahead for the United States and the world economy.

A paper monetary standard means there are no restraints on the printing press or on federal deficits. In 1971, M3 was $776 billion; today it stands at $8.9 trillion, an 1100% increase. Our national debt in 1971 was $408 billion; today it stands at $6.8 trillion, a 1600% increase. Since that time, our dollar has lost almost 80% of its purchasing power. Common sense tells us that this process is not sustainable and something has to give. So far, no one in Washington seems interested.

Although dollar creation is ultimately the key to its value, many other factors play a part in its perceived value, such as: the strength of our economy, our political stability, our military power, the benefit of the dollar being the key reserve currency of the world, and the relative weakness of other nation’s economies and their currencies. For these reasons, the dollar has enjoyed a special place in the world economy. Increases in productivity have also helped to bestow undeserved trust in our economy with consumer prices, to some degree, being held in check and fooling the people, at the urging of the Fed, that “inflation” is not a problem. Trust is an important factor in how the dollar is perceived. Sound money encourages trust, but trust can come from these other sources as well. But when this trust is lost, which always occurs with paper money, the delayed adjustments can hit with a vengeance.

Following the breakdown of the Bretton Woods agreement, the world essentially accepted the dollar as a replacement for gold, to be held in reserve upon which even more monetary expansion could occur. It was a great arrangement that up until now seemed to make everyone happy.

We own the printing press and create as many dollars as we please. These dollars are used to buy federal debt. This allows our debt to be monetized and the spendthrift Congress, of course, finds this a delightful convenience and never complains. As the dollars circulate through our fractional reserve banking system, they expand many times over. With our excess dollars at home, our trading partners are only too happy to accept these dollars in order to sell us their products. Because our dollar is relatively strong compared to other currencies, we can buy foreign products at a discounted price. In other words, we get to create the world’s reserve currency at no cost, spend it overseas, and receive manufactured goods in return. Our excess dollars go abroad and other countries-especially Japan and China- are only too happy to loan them right back to us by buying our government and GSE debt. Up until now both sides have been happy with this arrangement.

But all good things must come to an end and this arrangement is ending. The process put us into a position of being a huge debtor nation, with our current account deficit of more than $600 billion per year now exceeding 5% of our GDP. We now owe foreigners more than any other nation ever owed in all of history, over $3 trillion.

A debt of this sort always ends by the currency of the debtor nation decreasing in value. And that’s what has started to happen with the dollar, although it still has a long way to go. Our free lunch cannot last. Printing money, buying foreign products, and selling foreign holders of dollars our debt ends when the foreign holders of this debt become concerned with the dollar’s future value.

Once this process starts, interest rates will rise. And in recent weeks, despite the frenetic effort of the Fed to keep interest rates low, they are actually rising instead. The official explanation is that this is due to an economic rebound with an increase in demand for loans. Yet a decrease in demand for our debt and reluctance to hold our dollars is a more likely cause. Only time will tell whether the economy rebounds to any significant degree, but one must be aware that rising interest rates and serious price inflation can also reflect a weak dollar and a weak economy. The stagflation of the 1970s baffled many conventional economists, but not the Austrian economists. Many other countries have in the past suffered from the extremes of inflation in an inflationary depression, and we are not immune from that happening here. Our monetary and fiscal policies are actually conducive to such a scenario.

In the short run, the current system gives us a free ride, our paper buys cheap goods from overseas, and foreigners risk all by financing our extravagance. But in the long run, we will surely pay for living beyond our means. Debt will be paid for one way or another. An inflated currency always comes back to haunt those who enjoyed the “benefits” of inflation. Although this process is extremely dangerous, many economists and politicians do not see it as a currency problem and are only too willing to find a villain to attack. Surprisingly the villain is often the foreigner who foolishly takes our paper for useful goods and accommodates us by loaning the proceeds back to us.

It’s true that the system encourages exportation of jobs as we buy more and more foreign goods. But nobody understands the Fed role in this, so the cries go out to punish the competition with tariffs. Protectionism is a predictable consequence of paper- money inflation, just as is the impoverishment of an entire middle class. It should surprise no one that even in the boom phase of the 1990s, there were still many people who became poorer. Yet all we hear are calls for more government mischief to correct the problems with tariffs, increased welfare for the poor, increased unemployment benefits, deficit spending, and special interest tax reduction, none of which can solve the problems ingrained in a system that operates with paper money and a central bank.

If inflation were equitable and treated all classes the same, it would be less socially divisive. But while some see their incomes going up above the rate of inflation (movie stars, CEOs, stock brokers, speculators, professional athletes,) others see their incomes stagnate like lower-middle-income workers, retired people, and farmers. Likewise, the rise in the cost of living hurts the poor and middle class more than the wealthy. Because inflation treats certain groups unfairly, anger and envy are directed toward those who have benefited.

The long-term philosophic problem with this is that the central bank and the fiat monetary system are not blamed; instead free market capitalism is. This is what happened in the 1930s. The Keynesians, who grew to dominate economic thinking at the time, erroneously blamed the gold standard, balanced budgets, and capitalism instead of tax increases, tariffs, and Fed policy. This country cannot afford another attack on economic liberty similar to what followed the 1929 crash that ushered in the economic interventionism and inflationism which we have been saddled with ever since. These policies have brought us to the brink of another colossal economic downturn and we need to be prepared.

Big business and banking deserve our harsh criticism, but not because they are big or because they make a lot of money. Our criticism should come because of the special benefits they receive from a monetary system designed to assist the business class at the expense of the working class. Labor leader Samuel Gompers understood this and feared paper money and a central bank while arguing the case for gold. Since the monetary system is used to finance deficits that come from war expenditures, the military industrial complex is a strong supporter of the current monetary system.

Liberals foolishly believe that they can control the process and curtail the benefits going to corporations and banks by increasing the spending for welfare for the poor. But this never happens. Powerful financial special interests control the government spending process and throw only crumbs to the poor. The fallacy with this approach is that the advocates fail to see the harm done to the poor, with cost of living increases and job losses that are a natural consequence of monetary debasement. Therefore, even more liberal control over the spending process can never compensate for the great harm done to the economy and the poor by the Federal Reserve’s effort to manage an unmanageable fiat monetary system.

Economic intervention, financed by inflation, is high-stakes government. It provides the incentive for the big money to “invest” in gaining government control. The big money comes from those who have it- corporations and banking interests. That’s why literally billions of dollars are spent on elections and lobbying. The only way to restore equity is to change the primary function of government from economic planning and militarism to protecting liberty. Without money, the poor and middle class are disenfranchised since access for the most part requires money. Obviously, this is not a partisan issue since both major parties are controlled by wealthy special interests. Only the rhetoric is different.

Our current economic problems are directly related to the monetary excesses of three decades and the more recent efforts by the Federal Reserve to thwart the correction that the market is forcing upon us. Since 1998, there has been a sustained attack on corporate profits. Before that, profits and earnings were inflated and fictitious, with WorldCom and Enron being prime examples. In spite of the 13 rate cuts since 2001, economic growth has not been restored.

Paper money encourages speculation, excessive debt, and misdirected investments. The market, however, always moves in the direction of eliminating bad investments, liquidating debt, and reducing speculative excesses. What we have seen, especially since the stock market peak of early 2000, is a knock-down, drag-out battle between the Fed’s effort to avoid a recession, limit the recession, and stimulate growth with its only tool, money creation, while the market demands the elimination of bad investments and excess debt. The Fed was also motivated to save the stock market from collapsing, which in some ways they have been able to do.

The market, in contrast, will insist on liquidation of unsustainable debt, removal of investment mistakes made over several decades, and a dramatic revaluation of the stock market. In this go-around, the Fed has pulled out all the stops and is more determined than ever, yet the market is saying that new and healthy growth cannot occur until a major cleansing of the system occurs. Does anyone think that tariffs and interest rates of 1% will encourage the rebuilding of our steel and textile industries anytime soon? Obviously, something more is needed.

The world central bankers are concerned with the lack of response to low interest rates and they have joined in a concerted effort to rescue the world economy through a policy of protecting the dollar’s role in the world economy, denying that inflation exists, and justifying unlimited expansion of the dollar money supply. To maintain confidence in the dollar, gold prices must be held in check. In the 1960s our government didn’t want a vote of no confidence in the dollar, and for a couple of decades, the price of gold was artificially held at $35 per ounce. That, of course, did not last.

In recent years, there has been a coordinated effort by the world central bankers to keep the gold price in check by dumping part of their large horde of gold into the market. This has worked to a degree, but just as it could not be sustained in the 1960s, until Nixon declared the Bretton Woods agreement dead in 1971, this effort will fail as well.

The market price of gold is important because it reflects the ultimate confidence in the dollar. An artificially low price for gold contributes to false confidence and when this is lost, more chaos ensues as the market adjusts for the delay.

Monetary policy today is designed to demonetize gold and guarantee for the first time that paper can serve as an adequate substitute in the hands of wise central bankers. Trust, then, has to be transferred from gold to the politicians and bureaucrats who are in charge of our monetary system. This fails to recognize the obvious reason that market participants throughout history have always preferred to deal with real assets, real money, rather than government paper. This contest between paper and honest money is of much greater significance than many realize. We should know the outcome of this struggle within the next decade.

Alan Greenspan, although once a strong advocate for the gold standard, now believes he knows what the outcome of this battle will be. Is it just wishful thinking on his part? In an answer to a question I asked before the Financial Services Committee in February 2003, Chairman Greenspan made an effort to convince me that paper money now works as well as gold: “I have been quite surprised, and I must say pleased, by the fact that central banks have been able to effectively simulate many of the characteristics of the gold standard by constraining the degree of finance in a manner which effectively brought down the general price levels.”

Earlier, in December 2002, Mr. Greenspan spoke before the Economic Club of New York and addressed the same subject: “The record of the past 20 years appears to underscore the observation that, although pressures for excess issuance of fiat money are chronic, a prudent monetary policy maintained over a protracted period of time can contain the forces of inflation.” There are several problems with this optimistic assessment. First, efficient central bankers will never replace the invisible hand of a commodity monetary standard. Second, using government price indexes to measure the success of a managed fiat currency should not be reassuring.

These indexes can be arbitrarily altered to imply a successful monetary policy. Also, price increases of consumer goods are not a litmus test for measuring the harm done by the money managers at the Fed. The development of overcapacity, excessive debt, and speculation still occur, even when prices happen to remain reasonably stable due to increases in productivity and technology. Chairman Greenspan makes his argument because he hopes he’s right that sound money is no longer necessary, and also because it’s an excuse to keep the inflation of the money supply going for as long as possible, hoping a miracle will restore sound growth to the economy. But that’s only a dream.

We are now faced with an economy that is far from robust and may get a lot worse before rebounding. If not now, the time will soon come when the conventional wisdom of the last 90 years, since the Fed was created, will have to be challenged. If the conditions have changed and the routine of fiscal and monetary stimulation don’t work, we better prepare ourselves for the aftermath of a failed dollar system, which will not be limited to the United States.

An interesting headline appeared in the New York Times on July 31, 2003, “Commodity Costs Soar, But Factories Don’t Bustle.” What is observed here is a sea change in attitude by investors shifting their investment funds and speculation into things of real value and out of financial areas, such as stocks and bonds. This shift shows that in spite of the most aggressive Fed policy in history in the past three years, the economy remains sluggish and interest rates are actually rising. What can the Fed do? If this trend continues, there’s little they can do. Not only do I believe this trend will continue, I believe it’s likely to accelerate. This policy plays havoc with our economy; reduces revenues, prompts increases in federal spending, increases in deficits and debt occur, and interest costs rise, compounding our budgetary woes.

The set of circumstances we face today are unique and quite different from all the other recessions the Federal Reserve has had to deal with. Generally, interest rates are raised to slow the economy and dampen price inflation. At the bottom of the cycle interest rates are lowered to stimulate the economy. But this time around, the recession came in spite of huge and significant interest rate reductions by the Fed. This aggressive policy did not prevent the recession as was hoped; so far it has not produced the desired recovery.

Now we’re at the bottom of the cycle and interest rates not only can’t be lowered, they are rising. This is a unique and dangerous combination of events. This set of circumstances can only occur with fiat money and indicates that further manipulation of the money supply and interest rates by the Fed will have little if any effect.

The odds aren’t very good that the Fed will adopt a policy of not inflating the money supply because of some very painful consequences that would result. Also there would be a need to remove the pressure on the Fed to accommodate the big spenders in Congress. Since there are essentially only two groups that have any influence on spending levels, big-government liberals and big- government conservatives, that’s not about to happen. Poverty is going to worsen due to our monetary and fiscal policies, so spending on the war on poverty will accelerate.

Our obsession with policing the world, nation building, and pre-emptive war are not likely to soon go away, since both Republican and Democratic leaders endorse them. Instead, the cost of defending the American empire is going to accelerate. A country that is getting poorer cannot pay these bills with higher taxation nor can they find enough excess funds for the people to loan to the government. The only recourse is for the Federal Reserve to accommodate and monetize the federal debt, and that, of course, is inflation.

It’s now admitted that the deficit is out of control, with next year’s deficit reaching over one-half trillion dollars, not counting the billions borrowed from “trust funds” like Social Security. I’m sticking to my prediction that within a few years the national debt will increase over $1 trillion in one fiscal year. So far, so good, no big market reactions, the dollar is holding its own and the administration and congressional leaders are not alarmed. But they ought to be.

I agree, it would be politically tough to bite the bullet and deal with our extravagance, both fiscal and monetary, but the repercussions here at home from a loss of confidence in the dollar throughout the world will not be a pretty sight to behold. I don’t see any way we are going to avoid the crisis.

We do have some options to minimize the suffering. If we decided to, we could permit some alternatives to the current system of money and banking we have today.

Already, we took a big step in this direction. Gold was illegal to own between 1933 and 1976. Today millions of Americans do own some gold.

Gold contracts are legal, but a settlement of any dispute is always in Federal Reserve notes. This makes gold contracts of limited value.

For gold to be an alternative to Federal Reserve notes, taxes on any transactions in gold must be removed, both sales and capital gains.

Holding gold should be permitted in any pension fund, just as dollars are permitted in a checking account of these funds.

Repeal of all legal tender laws is a must. Sound money never requires the force of legal tender laws. Only paper money requires such laws.

These proposals, even if put in place tomorrow, would not solve all the problems we face. It would though, legalize freedom of choice in money, and many who worry about having their savings wiped out by a depreciating dollar would at least have another option. This option would ease some of the difficulties that are surely to come from runaway deficits in a weakening economy with skyrocketing inflation.

Curbing the scope of government and limiting its size to that prescribed in the Constitution is the goal that we should seek. But political reality makes this option available to us only after a national bankruptcy has occurred. We need not face that catastrophe. What we need to do is to strictly limit the power of government to meddle in our economy and our personal affairs, and stay out of the internal affairs of other nations.

Conclusion

It’s no coincidence that during the period following the establishment of the Federal Reserve and the elimination of the gold standard, a huge growth in the size of the federal government and its debt occurred. Believers in big government, whether on the left or right, vociferously reject the constraints on government growth that gold demands.

Liberty is virtually impossible to protect when the people allow their government to print money at will. Inevitably, the left will demand more economic interventionism, the right more militarism and empire building. Both sides, either inadvertently or deliberately, will foster corporatism. Those whose greatest interest is in liberty and self-reliance are lost in the shuffle. Though left and right have different goals and serve different special-interest groups, they are only too willing to compromise and support each other’s programs.

If unchecked, the economic and political chaos that comes from currency destruction inevitably leads to tyranny- a consequence of which the Founders were well aware. For 90 years we have lived with a central bank, with the last 32 years absent of any restraint on money creation. The longer the process lasts, the faster the printing presses have to run in an effort to maintain stability. They are currently running at record rate. It was predictable and is understandable that our national debt is now expanding at a record rate.

The panicky effort of the Fed to stimulate economic growth does produce what it considers favorable economic reports, recently citing second quarter growth this year at 3.1%. But in the footnotes, we find that military spending—almost all of which is overseas- was up an astounding 46%. This, of course, represents deficit spending financed by the Federal Reserve’s printing press. In the same quarter, after-tax corporate profits fell 3.4%. This is hardly a reassuring report on the health of our economy and merely reflects the bankruptcy of current economic policy.

Real economic growth won’t return until confidence in the entire system is restored. And that is impossible as long as it depends on the politicians not spending too much money and the Federal Reserve limiting its propensity to inflate our way to prosperity. Only sound money and limited government can do that.

(1) comments