Tuesday, October 30, 2007

It is hoped that the succinctness of this message is accepted in the tone of importance in which it is intended. The window of opportunity to accomplish the necessary monumental consciousness transition is small compared to the obstacle within the human belief systems that must be literally dissolved so that the whole may be transformed.

All the beliefs and expectations about who you are, where you are, and what you’re supposed to be doing, and how, and where, and when, let them go! You have nothing to fear in releasing these things. All that has been sanctified by God will continue to exist. Only that which has sought to cheat you of your destiny will perish. Let it all go and see what the Lord has in store.

Any hesitation you have is indicative in your continued trust in fear, and reason. These are the false Gods of this age. And they will continue to enslave you until your trust is restored in love and life. Trust God implicitly, and the truth of his divine design will be revealed in every situation. Specific information for each and every situation is being supplied to you constantly by the source of infinite wisdom. Why not trust it?

As soon as you begin to look outside yourself into the world around you to see how you can make yourself useful – as soon as you serve in the capacity you were created to fulfill, you will begin to share in the peace and happiness of your creation. You will experience a state of consciousness so superior to any you have experienced before, that it will make your previous life seem but a dream. When you actually see the kingdom of heaven in operation on Earth, all that you require for survival will be drawn to you like a magnet. Life will be simple and easy. Problems will fall away like dust from your eyes. With great clarity and peace, you will begin to do what needs to be done. Life will begin to work extraordinarily well. Do not focus on the world that is polarizing towards selfishness and fear. Do not pay attention to the old that is crumbling around you. What has been shall soon be no more. Let the dead bury their dead, and concentrate solely on the building of the new.

We are the one's we have been waiting for!

You have been telling the people,

That this is the eleventh hour.

Now, you must go and tell the people,

That THIS is the hour,

And there are things to be considered.

Where are you living? What are you doing?

What are your relationships?

Are you in the right relationship?

Where is your water?

Know your garden ...

It is time to speak your truth.

Create your community,

Be good to each other.

Do not look outside yourself for a leader.

There is a river flowing now very fast,

It is so great and swift.

That there are those who will be afraid,

They will try to hold onto the shore.

They will feel they are being pulled apart,

And will suffer greatly.

Understand that the river knows its' destination,

The elders say we must let go of the shore.

Push off into the middle of the river,

Keep our eyes open and our heads above water.

And I say; see who is in there with you,

Hold fast to them and celebrate!

At this time in history,

We are to take nothing personally.

Least of all, ourselves!

For the moment we do,

Our spiritual growth and journey comes to an end.

The time of the Lone Wolf is over!

Gather yourselves!

Banish the word 'struggle' from

Your attitude and vocabulary.

All that we do now must be done,

In a sacred manner and in celebration.

We are all about to go on a journey,

We are the one's we have been waiting for!

--- Thomas Banyacya Sr. (1910-1999);

Speaker of the Wolf, Fox and Coyote Clan

Elder of the Hopi Nation

Labels: We Are The One's We Have Been Waiting For

(0) comments

Saturday, October 27, 2007

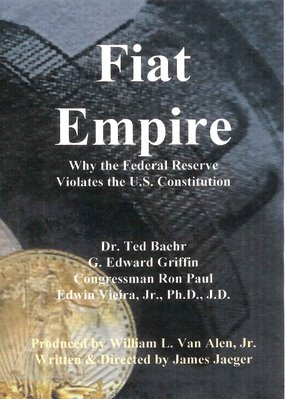

--Ron Paul

(0) comments

Monday, October 01, 2007

Media Blackout:161 Federal Tax Charges, 0 ConvictionsIRS Suffers Staggering Defeat

Tax Questions Raised RegardingGold and Silver Coins Used to Pay Wages

Around noon on Monday, September 17th, a Las Vegas federal jury returned its verdict refusing to convict nine defendants of any of the 161 federal tax crimes they had been charged with. The charges included income tax evasion, willful failure to file and conspiracy to evade taxes.The four-month trial centered around the family businesses of Robert Kahre who paid numerous workers for their labor with circulating gold and silver U.S. coins, and did not report the wages. The payments took place over several years, allegedly totaling at least $114 million dollars. On September 20, 2007, three days after the federal trial's dramatic conclusion, the Las Vegas Review Journal, reportedly under a degree of public pressure, ran its first (and last) story about the outcome of the trial. To this day, with exception of the single article by the Review Journal, no major media entity has published a news story regarding the outcome of this important federal criminal tax case.

The censorship of this important news story is, unfortunately, not unexpected given the continuing, worldwide onslaught against the U.S. "dollar" -- specifically the Federal Reserve variety, and the ever growing numbers of Federal Reserve Notes required to trade for an actual ounce of silver, gold, oil, or for that matter, anything. In short, this failed prosecution has coalesced and exposed truths our Government desperately needs to hide from the People: the truth about our money, the truth about our (privately-owned) central bank, and the truth about the fraudulent nature of the operation and enforcement of the federal income tax system. Click here to read the April, 2005 DOJ press release announcing the prosecution.Click here to read the 9/20 story by the Review Journal about the trial.

According to defense attorney Joel Hansen, who represented co-defendant Alex Loglia, the primary "willfulness" defense was that the defendants believed they had no legal obligation to withhold, pay income taxes or report anything to the government because, in part, the nominal (i.e., face value) of the gold and silver coins is so small as to fall beneath the reporting thresholds set by the Internal Revenue Code.The Defendants also argued that regardless of the valuation of the coins for internal revenue purposes, there is no law that requires average American workers to file or pay direct, un-apportioned taxes on the fruits of their labor.The Government argued that the payments in solid gold and silver U.S. coins must be considered at their bullion (i.e., intrinsic full-market) value when considering the worth of the wages for purposes of the internal revenue code.Attorney Hansen cited two Supreme Court cases bolstering Defendant's monetary argument at the heart of the defendants "willfulness" defense. The essence of the argument is that under the Constitution Congress is obligated by law to mint and circulate such coins as demand requires, and must establish the value of coins as they are used as legal tender, but the coins' market value, arising as valuable personal "property," is a distinct, separate attribute of such coins, and is of no legal consequence if the coins are used as legal tender. In other words, if a worker is paid with such coins, his taxable "income" (if any) can only be the face value indicated upon the coin money paid -- i.e., $1.00 for a circulating silver dollar or $50 for a circulating gold U.S. coin. Not surprisingly, the IRS has never issued any public guidance regarding this significant issue.

The first case, Ling Su Fan v. U.S., 218 US 302 (1910) establishes the legal distinction of a coin bearing the "impress" of the sovereign:

"These limitations are due to the fact that public law gives to such coinage a value which does not attach as a mere consequence of intrinsic value. Their quality as a legal tender is an attribute of law aside from their bullion value. They bear, therefore, the impress of sovereign power which fixes value and authorizes their use in exchange."

The second case, Thompson v. Butler, 95 US 694 (1877), establishes that the law makes no legal distinction between the values of coin and paper money used as legal tender:

"A coin dollar is worth no more for the purposes of tender in payment of an ordinary debt than a note dollar. The law has not made the note a standard of value any more than coin. It is true that in the market, as an article of merchandise, one is of greater value than the other; but as money, that is to say, as a medium of exchange, the law knows no difference between them."

Defense attorney Hansen confirmed that members of the jury were able to actually hold and inspect the gold and silver U.S. coins paid to the workers.After almost four months of testimony and three and a half days of deliberation, the jury did not convict any of the defendants of any of the 161 crimes alleged. Although some defendants were acquitted of multiple counts, and several were acquitted completely, others may have to stand for a retrial if the Government brings charges a second time.The Review Journal reported the jury foreman claimed DOJ prosecutors admitted they were "shocked" by the outcome.

In March 2007, the primary defendant, Bob Kahre, filed a federal civil rights lawsuit against the prosecutor and IRS agents who had conducted what he alleges to be an unlawful search and seizure raid. In 2005, the Ninth Circuit Court of Appeals refused to overturn a previous District Court ruling holding that the federal prosecutor is not entitled to absolute immunity for the unlawful raid. Read more.

Click here to execute a Google News search to attempt to locate recent news stories about the Kahre tax trial. The media suppression of this story is similar to the widespread mainstream media suppression of the July 11, 2007 acquittal of Louisiana attorney Tommy Cryer who was also charged with multiple federal income tax crimes and relied upon numerous Supreme Court precedents and U.S. tax laws to establish his "willfulness" defense. Click here for a previous WTP update containing a link to Cryer's 100-page Motion to Dismiss which details his legal arguments. Click here to execute a Google News archive search to attempt to locate news stories about Tommy Cryer's tax trial.

PLEASE NOTE: Following recent statements by the DOJ, most of the content of the WTP websites (including our on-line store) has been fully restored for public access. The "6700" case is currently being appealed to the Second Circuit Court of Appeals.History is made by those who show up and make it happen. Please help us continue our epic fight by making a donation. If we have no funds, the battle cannot be fought.

To make a secure, tax-deductible donation to the WTP Foundation, please click here: Donation. You can make a one-time or recurring donation and can also establish the dates the secure transactions are processed each month.

Update Related Links

Access all the 6700 Lawsuit Filings and Court Orders.

L for Liberty !Donate and receive the full recordof the GML 2007 conference.23 powerful speakers, 20 hours of compelling videoincluding banquet speakers and video of the"V" White House protest and bonus supporting materials!On (2) DVD-ROM discs. Immediate shipping...Click here to learn more and to obtainthe GML 2007 record on DVD-ROMWatch the video preview: Cable connection Dial-Up connection

Please remember:The Landmark Right-To-Petition Lawsuit and Operations of the WTP Foundationare Funded Solely By Your Generous Support.

(0) comments